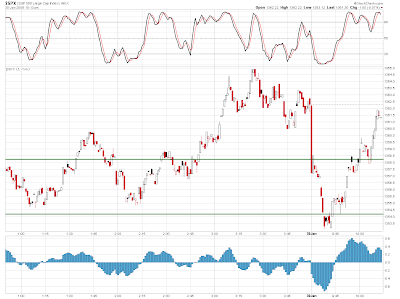

PIVOT POINTS FOR SPY

************************

R1 - 144.37.... R2 - 151.46.... R3 - 164.14.... R4 - 176.82

*************************************************

S1 - 131.69.... S2 - 126.10.... S3 - 113.42.... S4 - 100.74

*********************************

PROJECTED RANGE FOR SPY

*********************************

HIGHS - 140.76 & 144.24

LOWS - 133.78 & 130.30